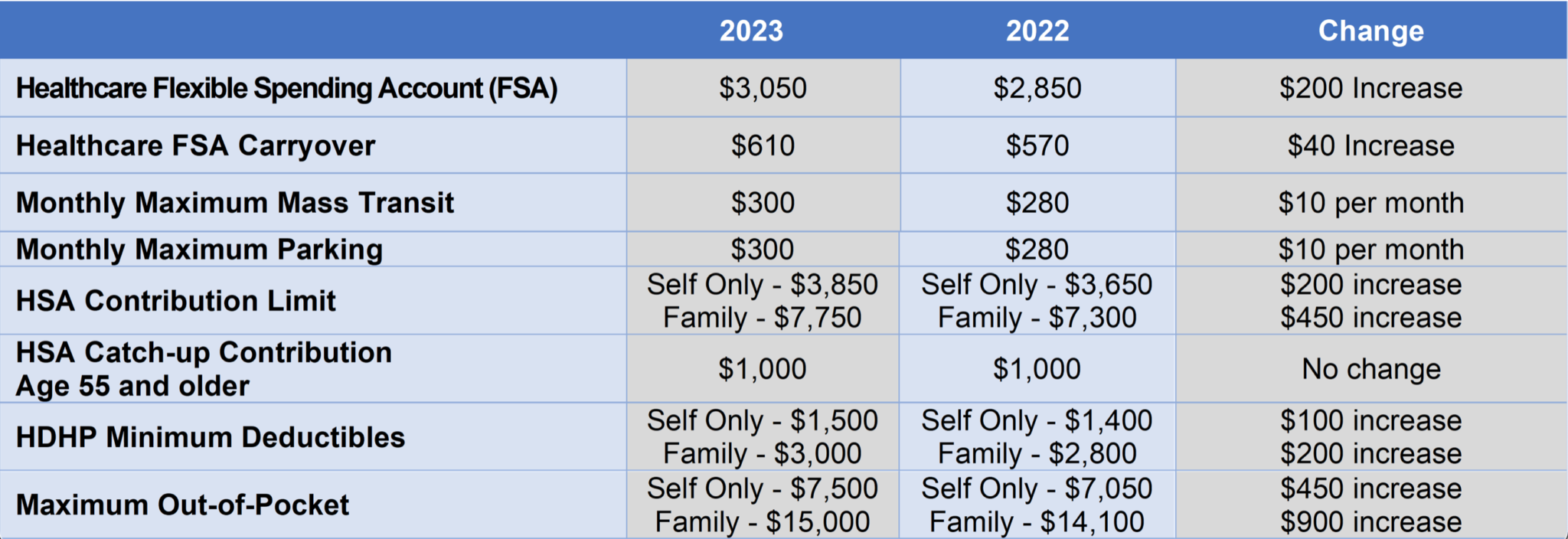

Maximum Flexible Spending Account 2025. Health care flexible spending account. The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025.

Health care flexible spending account (fsa) contribution limit. The federal flexible spending account program (fsafeds) is sponsored by the u.s.

Tax Benefits of Flexible Spending Accounts, Amounts contributed are not subject to. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

What Is a Flexible Spending Credit Card? Lexington Law, Flexible spending account (fsa) rules, limits & expenses. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, Join us to learn a few. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Flexible Spending Accounts How They Work?, The new hsa contribution limits for 2025 are $4,150 for single individuals (up from $3,850 in 2025) and $8,300 for family coverage (up from $7,750 in 2025). But smart spending requires careful planning.

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

A Quick Guide To Flexible Spending Accounts The Thought Card, 2025 last day to submit claims is april 30, 2025. If you had a flexible spending account (fsa) prior to 2025, you’ve probably heard the phrase “use it.

FSAs (Flexible Spending Accounts) What Are They and What Are Their, If you had a flexible spending account (fsa) prior to 2025, you’ve probably heard the phrase “use it. For 2025, there is a $150 increase to the contribution limit for these accounts.

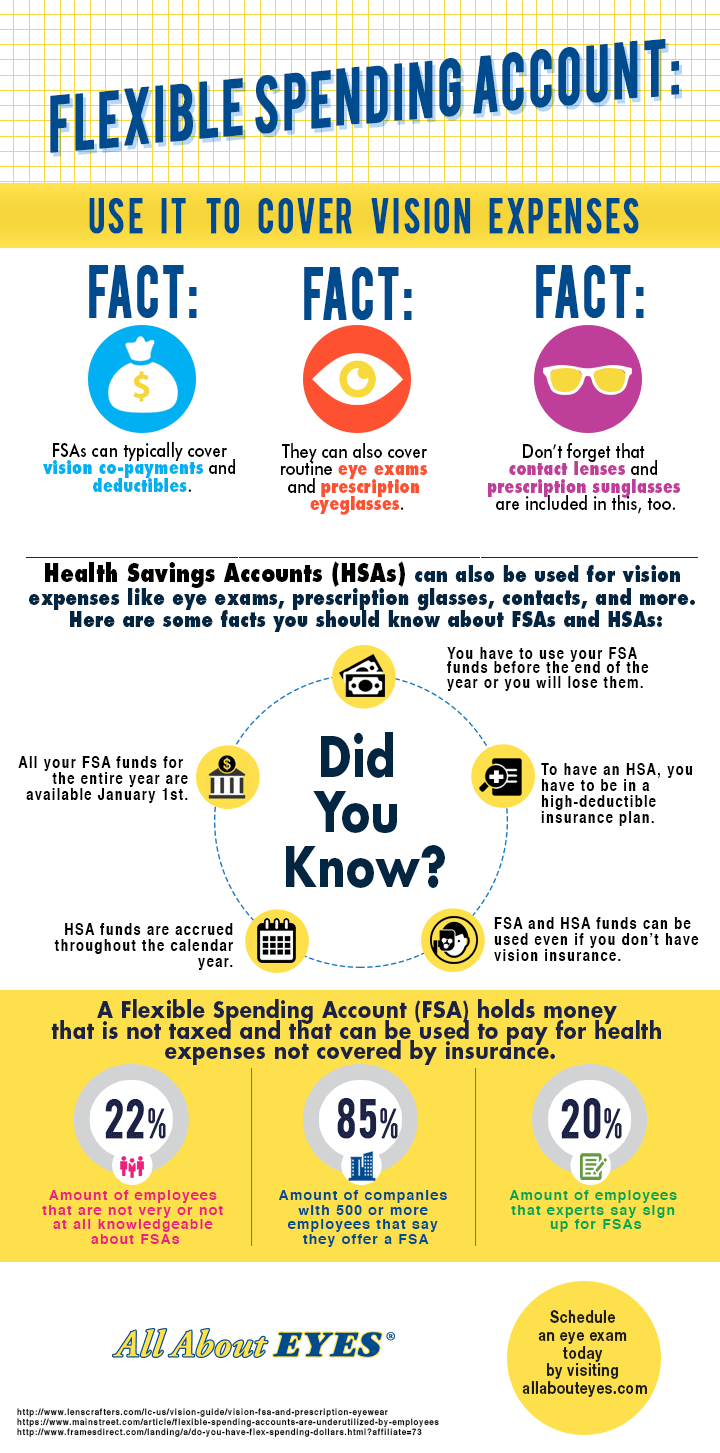

Your Flexible Spending Account Use it to Cover Vision Expenses All, Amounts contributed are not subject to. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

FSAFEDS Special Open Enrollment Period and New Flexibilities for, Office of personnel management and. Here, a primer on how.

Flexible Spending Account Eligibility, Contribution Limit, Types, For 2025, there is a $150 increase to the contribution limit for these accounts. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

Flexible Spending Account The Workplace Benefit You Need to Check Out, The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose. Health care flexible spending account.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Travel Hiking WordPress Theme By WP Elemento